Nguyen Huy Hoang, Partner, Bross & Partners

Former Banker at BIDV

Email: hoang@bross.vn

Doan Thanh Binh, Senior Associate, Bross & Partners

Email: binh.dt@bross.vn

Letter of Credit or Documentary Credit (abbreviated as “L/C”) is a method that has developed into an international practice and is now widely used in cross-border trade transactions. In recent years, the General Department of Taxation (“GDT”) has instructed on imposing value-added tax (“VAT”) on L/C transaction fees arising from January 1, 2011, invoking mixed reactions from credit institutions[1].

There are two conflicting views between 02 ministerial-level agencies, namely the State Bank of Vietnam (“SBV”)[2] and the Ministry of Finance (“MOF”)[3] regarding the plans of collecting VAT for L/C activities from January 1, 2011 and this discrepancy has been reported and consulted with the Prime Minister for solutions[4], whereas (i) the SBV, the Vietnam Banking Association (“VNBA”), several member credit institutions and the Banking Working Group (“BWG”) under the Vietnam Business Forum Alliance, who represent credit institutions and foreign bank branches in Vietnam all opine that L/C activities are “dual” in nature, both a payment service and a credit extension activity, therefore, these parties proposed to impose VAT only on L/C service charges that are of a payment service nature[5]; on the contrary, (ii) the MOF and GDT argue that according to Law on Credit Institutions No. 47/2010/QH12 (“Law on Credit Institutions 2010”), L/C is a form of payment service so it will not be excluded from VAT as from January 1, 2011[6].

As such, is an L/C arrangement a payment service or a credit extension activity or is it of a “dual” nature, i.e., both a payment service and a credit extension activity? In this article, we will discuss on the regulations related to L/C and analyze the nature of L/C and L/C-related operations that banks have been providing to customers, thereby determining the credit attributes of L/C; whereas other related issues such as (i) the legality and reasonableness of the collection of VAT on L/C transaction fees from January 1, 2011, (ii) VAT and the experience and approach to collecting VAT relating to L/C in some other countries, and (iii) the validity and legal value of guidance letters in Vietnam will be discussed in upcoming articles.

1. Overview of Letters of Credit and related regulations

1.1 The Letter of Credit (L/C) Concept

Article 1, the Uniform Custom and Practice for Documentary Credits effective July 1, 2007 (UCP 600) of the International Chamber of Commerce (“UCP 600”) provides that the “Uniform Custom and Practice for Documentary Credits, 2007 Revision, ICC publication number 600 (“UCP”) is the rules that apply to any documentary credit (“credit”) (including standby letters of credit to the extent that these rules are applicable)”. It should be noted that UCP 600 is a set of international trade custom with a legal source status that also has been stipulated by Vietnamese law[7] and in practice it has been referenced and applied by all banks in Vietnam in relation to L/C operations[8].

According to the UCP 600, “Credit means any arrangement, however named or described, that is irrevocable and thereby constitutes a definite undertaking of the issuing bank to honour a complying presentation”[9]; “A credit by its nature is a separate transaction from the sale or other contract on which it may be based. Banks are in no way concerned with or bound by such contract, even if any reference whatsoever to it is included in the credit”[10]; and “ Banks deal with documents and not with goods, services or performance to which the documents may relate”[11]

However, UCP 600 only defines “credit” without defining letter of credit (L/C), but based on Article 1, UCP 600, one may refer to L/C as follows: “Letter of credit is a commitment of the Issuing Bank (the bank serving the Buyer) to pay a certain amount of money, within a certain period of time to the beneficiary (the Seller) provided that the beneficiary presents a valid set of documents as specified in the Letter of Credit.”[12].

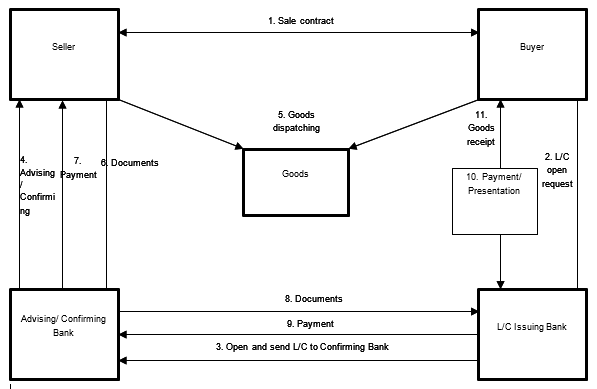

A basic L/C transaction can be illustrated by the diagram below:[13]

1.2 Regulations of Vietnamese law on L/C

Before the Law on Credit Institutions 2024, which takes effect from July 1, 2024 (“Law on Credit Institutions 2024”), Vietnamese authorities have not issued any documents defining or detailing credit extension activities of L/C. Previously, L/C was only mentioned in some documents such as the Law on Credit Institutions 2010[14]. According to Clause 15, Article 4 of the Law on Credit Institutions 2010, L/C is one of the listed payment services[15]. However, according to Clause 14, Article 4 of the Law on Credit Institutions 2010, “Credit extension is an agreement for organizations or individuals to use a sum of money or commit to allow the use of an amount of money on the principle of repayment by means of lending, discounting, financial leasing, factoring, bank guarantees and other credit extension operations”. Therefore, later with the provisions of Circular No. 22/2019/TT-NHNN dated November 22, 2019 of the State Bank (“Circular 22”), L/C is also considered a credit extension business in addition to payment services. However, it should be noted that Circular 22 is a legal document regulating the limits and safety ratios in banks' operations, but in Clause 11, Article 3, Circular 22 defines that “Credit extension” includes “Issuance commitment in the form of a documentary letter of credit (L/C)”, whereby “issuance commitment” means only one of the operations related to L/C under UCP 600.

The Law on Credit Institutions 2024 defines and regulates L/C as a credit extension activity in addition to being one of the means of payment. Accordingly, Clause 4, Article 4 of the Law on Credit Institutions 2024 stipulates that “Credit extension is an agreement for an organization or individual to use a sum of money or commit to allow the use of an amount of money on the principle of repayment by financial lending, discounting, leasing, factoring, bank guarantee, letter of credit and other credit extension operations” and Clause 36, Article 4 of the Law on Credit Institutions 2024 stipulates that “Letter of credit is a form of credit extension through the operation of issuing, confirming, negotiating payment and refunding letters of credit”. In addition, L/C is regulated as one of the payment via account services, specifically Point b, Clause 6, Article 107 of the Law on Credit Institutions 2024 stipulates “Provide the following payment services via accounts: Perform international payment services after obtaining written approval from the State Bank; other payment services as prescribed by the Governor of the State Bank”.

Thus, L/C is both a credit extension activity and a payment service that has been legislated by the Law on Credit Institutions 2024 effective from July 1, 2024. To our knowledge, SBV is currently developing a draft circular regulating L/C operations and other business activities related to L/C[16]. Meanwhile, before the Law on Credit Institutions 2024, the law only stipulates the nature of L/C (actually only limited to the “issuance commitment” relating to L/C – one of the operations of L/C under the provisions of UCP 600) as a credit extension activity in Circular 22, which only takes effect from January 1, 2020.

1.3 The credit nature of L/C?

As such, L/C is (i) a payment service; or (ii) a credit extension activity; or (iii) both a credit extension activity and a payment service?

In our opinion, to answer the above question, one should not only rely on the provisions of the law related to L/C activities but also on the attributes of L/C that constitute its essence and the operations related to L/C that have been prescribed in the multiple versions of UCP, and have been legally provided by banks to customers.

According to Article 1, UCP 600 “ Letter of credit is a commitment of the Issuing Bank (the bank serving the Buyer) to pay a certain amount of money, within a certain period of time to the beneficiary (the Seller) provided that the beneficiary presents a valid set of documents as specified in the Letter of Credit”[17].

To some extent, L/C can be understood as one of the “bank credit” operations between the L/C Issuing Bank and the Seller of goods and services, usually the Exporter (although this is not a standard interpretation), whereby the Issuing Bank undertakes to act in place of the Buyer to “pay a certain amount of money, within a certain period of time to the Seller upon receipt of a valid set of documents in accordance with the provisions of the L/C”. Thus, instead of the Buyer (usually the Importer) committing to pay the Seller “a certain amount of money, within a certain period of time” – a form of “trade credit”[18] – after the Seller’s dispatching the goods, the Issuing Bank with fulfil its commitment to pay the Seller according to the Buyer's request to provide L/C issuance.

In this sense, by the Issuing Bank’s issuing the L/C to the Seller, bank credit has arisen only between NHPH and Seller in lieu of the trade credit between Buyer and Seller. However, from this perspective, it can be seen that L/C does not have the attributes as a credit extension from the Issuing Bank to the Buyer.

On the other hand, there are some opinions that “L/C is an international payment guarantee method, which is actually a payment commitment of the issuing bank, ensuring that the buyer will pay for the purchase of goods to the seller when the conditions specified in the L/C are properly and fully fulfilled. If the buyer fails to pay on time, the issuing bank makes a compulsory loan to the buyer to pay the seller.”[19] Identifying L/C as an international payment guarantee method was a common view in previous years. This view, in our opinion, does not accurately reflect the nature of L/C in general, except for standby L/C, which though called L/C, is inherently a bank guarantee[20].

The difference between L/C (except standby L/C) and bank guarantee can be demonstrated as follows: According to Clause 18, Article 4 of the Law on Credit Institutions 2010, “Bank guarantee is a form of credit extension, with which a credit institution commits to the guaranteed creditor that the credit institution will perform financial obligations on behalf of the customer when the customer does not perform or fulfill the committed obligations;...”[21]. There are multiple types of bank guarantees and if only classified according to the purpose of use, there will be domestic and foreign payment guarantees. According to the provisions of Clause 18, Article 4 of the Law on Credit Institutions 2010, for payment guarantee, the bank will only have to perform payment obligations on behalf of the customer (debtor) when the customer fails to pay or does not pay in full as committed as agreed between the customer and the guaranteed creditor. In addition, before performing the obligation to pay on behalf of the customer, the bank, in addition to basing on the letter of guarantee, also bases on the commitments specified in the customer's agreement with the guaranteed creditor. Meanwhile, for L/C, according to the provisions of UCP 600, L/C is separate and independent of the contract for sale and purchase of goods and services between the seller and the buyer[22], and the bank pays on behalf of the customer only on the basis of whether a valid set of documents is in compliance with the L/C or not[23]. These are two of the reasons why international payment guarantee and L/C are two different operations.

Therefore, the view that L/C is an international payment guarantee method may not be consistent with the inherent nature of L/C. The other proof is that there is no legal document regulating L/C as an international payment guarantee method. Moreover, after many years, L/C is defined and regulated as one of the credit extension activities besides payment services that have been codified by the Law on Credit Institutions 2024.

According to UCP, L/C is the commitment of the issuing bank to pay the Buyer when the Seller presents a complete set of documents and in accordance with the provisions of L/C. In this broad sense along with the process and operations that the bank provides to customers before issuing L/C in practice, it can be seen that L/C is a bank's credit extension activity similar to a bank guarantee. According to UCP, L/C-related operations provided by banks to customers include many different types of operations and are classified into 02 groups: (i) Credit operations including issuance, confirmation, payment negotiation and L/C refund; (ii) Operations without credit nature include services other than the above-mentioned operations[24] such as L/C advising and some other activities (without payment commitment)[25].

In the L/C operation currently performed by banks in practice, the bank issues L/C to the beneficiary on the principle of repayment, namely the customer (Buyer) who offers to issue L/C must repay the bank in accordance with the L/C issuance agreement between the customer and the bank[26]. In fact, according to the L/C issuance process of banks, in order to be issued L/C by banks, customers must have an L/C issuance request together with relevant documents and documents such as contracts for sale and purchase of goods, etc., (“L/C issuance application”). After receiving the customer's L/C issuance application, the bank will appraise this dossier, including verifying the customer's L/C payment source before approving the L/C issuance, and at the same time approving the L/C payment source. There are many types of L/C such as Sight Payment L/C[27], Deferred Payment L/C, Acceptance L/C, Irrevocable L/C, Revocable L/C, etc. Typically, the sources of L/C repayment include (i) funds available on the customer's checking account, and to secure the source of payment, normally the customer deposits 100% of the L/C value in the same L/C currency, or (ii) other sources, mainly bank loans for L/C payments including itemized loans or credit lines.

Regarding the customer's repayment obligations to the bank after L/C payment, in cases where: (i) in the L/C issuance agreement between the customer and the bank, there is no agreement allowing the bank to automatically deduct from the customer's checking account for L/C payment or there is this agreement but the balance on the customer's checking account not enough to repay the L/C[28], the bank will perform compulsory lending operations for the customer[29] according to the loan agreement pre-signed before issuing L/C. Because issuing L/C contains risks to banks' operations, especially when it comes to compulsory lending, L/C activities are listed as one of the activities that must be imposed limits and safety ratios as in Circular 22.

According to Clause 4, Article 4, Law on Credit Institutions 2024, “Credit extension is an agreement for organizations or individuals to use a sum of money or commit to allow the use of an amount of money on the principle of repayment…”; therefore, the regulation of L/C as one of the credit extension activities besides payment services (depending on L/C operations) does not only accurately reflect the nature of L/C but also the L/C-related operations that banks have been providing to customers, which in fact has been long established under the UCP (currently UCP 600) – an international trade custom that have been recognized by Vietnamese law[30] and referenced and applied by all banks in Vietnam[31].

Disclaimer: Please note that this article is not a comprehensive legal opinion for any particular case. Please consult a professional in case you encounter relevant legal issues.

BROSS & Partners is a Vietnamese law firm proposed by Legal 500 Asia Pacific, Chamber Asia Pacific, AsiaLaw, IFLR1000, Benchmark Litigation, with experience and capacity to advise and resolve disputes related to Investment, Enterprise and Commerce, Mergers & Acquisitions, Labor & Employment, Real Estate & Construction, Finance – Banking, Securities, Capital Markets, and Intellectual Property.

If you need assistance, please contact: hoang@bross.vn; mobile: +84 903 556 119; WhatApps: +84 903 556 119; Zalo: +84 903 556 119.

[1] Ho Thanh Binh – Department of Legal Affairs of the State Bank, Problems in determining value-added tax collection for Letters of Credit (L/C), Tap chi Nghien cuu Lap phap, (Legislative Studies Journal), No. 15(439)-August 2021, p. 34.

[2] Dispatch 9463/NHNN-TD dated 11/12/2023, Dispatch 583/NHNN-TD dated January 25, 2024.

[3] Official Dispatch 553/BTC-TCT dated January 12, 2024.

[4] Notice No. 324/TB-VPCP dated August 12, 2023.

[5] BWG's Dispatch No. 08122023BWCVBF dated December 8, 2023

[6] Official Letter No. 1606/TCT-DNL dated April 22, 2020 of the General Department of Taxation.

[7] Article 3.4 of the Law on Credit Institutions 2010.

[8] Official Letter No. 08122023BWGVBF dated December 8, 2023 of the Vietnam Business Forum.

[10] Article 4(a) UCP 600.

[12] Ho Thanh Binh – Department of Legal Affairs of the State Bank, Problems in determining value-added tax collection for Letters of Credit (L/C), Tap chi Nghien cuu Lap phap, (Legislative Studies Journal), No. 15(439)-August 2021, p. 35.

[13] Tran Thi Hoa Binh & Tran Van Nam (ed), Textbook of International Trade Law, Labor-Social Publishing House, 2005, p. 296.

[14] Ho Thanh Binh – Department of Legal Affairs of the State Bank, Problems in determining value-added tax collection for Letters of Credit (L/C), Tap chi Nghien cuu Lap phap, (Legislative Studies Journal), No. 15(439)-August 2021, p. 35.

[15] Clause 15, Article 4, Law on Credit Institutions 2010.

[16] Chi Tin, State Bank developing circular on letters of credit, Thoi bao Tai chinh (Financial Times), March 13, 2024.

[17] Ho Thanh Binh – Department of Legal Affairs of the State Bank, Problems in determining value-added tax collection for Letters of Credit (L/C), Tap chi Nghien cuu Lap phap, (Legislative Studies Journal), No. 15(439)-August 2021, p. 35.

[18] Trade credit is “a type of credit in the form of traders advancing funds to each other or borrowing from each other, either by selling goods or through the circulation of promissory notes, thereby smoothing and promoting the circulation of capital” (Vietnam Encyclopedia, vol. 4, p. 414).

[19] Ngo Hai, Bui Trang, Imposing VAT on the entire Letter of Credit operation is an inadequacy, causing many difficulties for credit institutions, Journal of Finance and Currency, No. 6 (567), 2021.

[20] “The issuing bank undertakes to pay the beneficiary on the basis of presenting documentation of the breach of the client's obligation to open a standby Letter of Credit. Therefore, a standby letter of credit is a commitment to fulfill financial obligations on behalf of a customer when a customer breaches obligations to a beneficiary and is a form of bank guarantee” - Ho Thanh Binh – Legal Department of the State Bank, Problems in determining value-added tax collection for Letter of Credit (L/C), Tap chi Nghien cuu Lap phap, (Legislative Studies Journal), No. 15(439)-August 2021, p. 37.

[21] Now Clause 18, Article 4 of the Law on Credit Institutions 2024.

[22] Article 4(a) UCP 600

[23] “Banks deal with documents and not with goods, services or performance to which the documents may relate.” - Article 5 UCP 600.

[24] Official Dispatch No. 08122023BWGVBF dated December 8, 2023 of the Vietnam Business Forum, page 3.

[25] Ngo Hai, Bui Trang, Imposing VAT on the entire Letter of Credit operation is a drawback, causing many difficulties for credit institutions, Tap chi Tai chinh – Tien te (Journal of Finance and Currency), No. 7 (567), 2021.

[26] Ho Thanh Binh – Legal Department of the State Bank, Problems in determining value-added tax collection for Letters of Credit (L/C), Tap chi Nghien cuu Lap phap, (Legislative Studies Journal), No. 15(439)-August 2021, p. 36.

[27] “The basic feature of this type of L/C is that the exporter is paid as soon as the appropriate set of documents is presented. Immediate payment is understood to be within 05 working days of the bank” – Talk about UPAS, Website of the State Bank of Vietnam dated February 2, 2023.

[28] That's the theory. In fact, if the customer has a balance in the current account, the bank will require the customer to make a deposit before issuing the L/C, unless otherwise agreed.

[29] Ho Thanh Binh – Legal Department of the State Bank, Problems in determining value-added tax collection for Letters of Credit (L/C), Tap chi Nghien cuu Lap phap, (Legislative Studies Journal), No. 15(439)-August 2021, p. 36.

[30] Article 3.4 of the Law on Credit Institutions 2010.

[31] Official Letter No. 08122023BWGVBF dated December 8, 2023 of the Vietnam Business Forum.